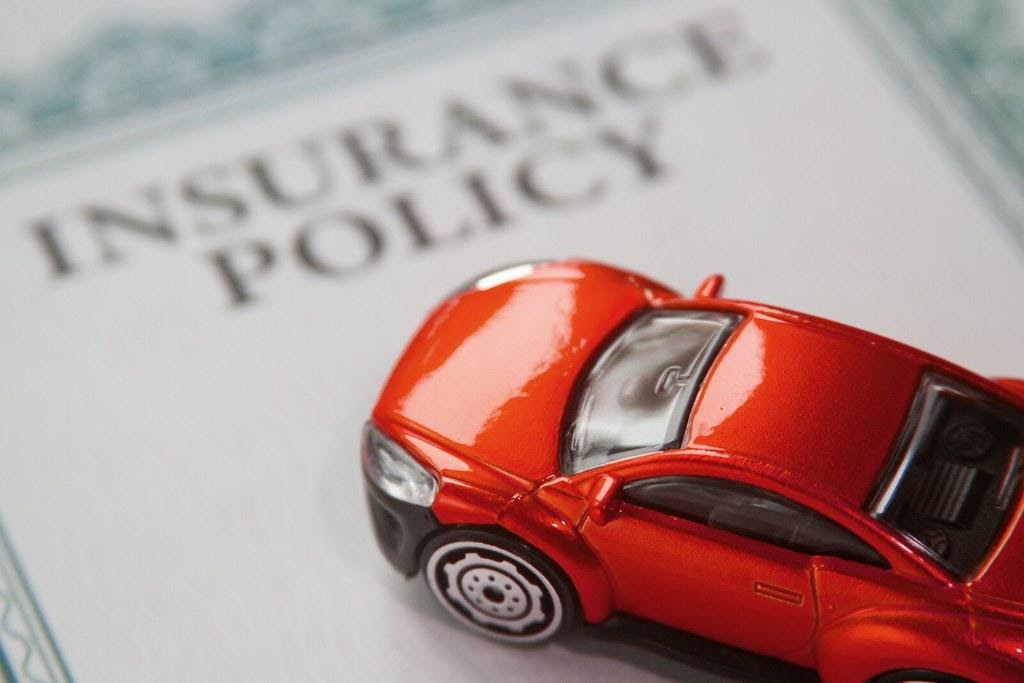

Step by step guide on how to renew your car insurance.

Maintaining a car is a difficult task. If you want to keep your vehicle in good shape, there are a lot of things to think about and do. That is why it is critical to have automobile insurance.

It’s a huge step toward ensuring that your car is well-protected from the bumps on life’s unending roadways.

However, everything is limited by time. In other words, everything expires at some point in time. Car insurance is no different in this respect, and after it has expired, there is only one thing to do next. Renew it.

How do you renew your car insurance? That is what we shall cover in this post. Here is a step-by-step guide on how to renew your car insurance.

How can I renew my car insurance?

In the past, renewing a car insurance policy, like any other task, was like climbing a mountain.

It required a lot of huffing and puffing. Endless phone calls and equally countless visits to your insurance agent\s office consisting of conversations that probably gave headaches was the order of the day.

Brutal right? You might have even been tempted not to renew thanks to the stress.

Luckily, thanks to technology, there is an ease of access to almost everything, and car insurance renewals are not left out of the bundle.

It is so easy now that you can renew your policy in minutes online using your mobile device or computer. Some insurance companies even let you renew using USSD codes.

What do I need to renew my car insurance?

If you are looking to renew your car insurance, there are a few requirements you need. They are;

- Your full name

- Your home and work address

- Details about your car; its make and model number

- Legal details such as the vehicle registration number of your car

- The insurance policy number of the old insurance policy

- Any additional benefits for the insurance policy (perhaps you want to change your type of policy or add another to it)

- Payment details

Step-by-Step car insurance renewal

These are the steps to take in renewing your insurance;

- Review various insurance companies and their car insurance policies: Your first move is to make a list of insurance companies you could renew with, and compare their services. You do this because there could always be something better out there and you should want value for your money. Choosing the best policy is easy; you just need to find what best suits you. Usually, companies with great presale and after-sales services are the best to go with. If you do want to continue with your previous provider, then go ahead to get a quote from them. Make use of an insurance calculator to help you determine how much your car will be covered and how much you will be paying as premium.

- Select the type of insurance: After choosing the insurance company, the next step is to pick what type of car insurance you will be taking. You could go with comprehensive car insurance which covers damages done to your car and other vehicles or third party car insurance which exclusively covers any damages done to other cars. Some insurance companies have other specific insurance policies.

- Fill in your details: After choosing which policy you are going with, you provide your required details to the insurance provider.

- Choose insurance policy Add-ons: Add-ons are added benefits to your policy that increases the range of what it initially covers. Add-ons can range from zero depreciation (where the depreciated value of the value is not considered) to services like roadside assistance, where in the event your car breaks down on the road, the insurance policy offers you minor repairs and replacements et cetera.

- Pay for your insurance policy: After all has been said and done, what’s next is to complete the process with payment, and you are good to go.

CONCLUSION

It’s as simple as ABC to renew your insurance policy. You do not need to be concerned or concerned when it expires; simply follow the instructions outlined above and enjoy your security.